Tax-Loss Harvesting Strategies: Smart Year-End Moves to Cut Your 2025 Taxes

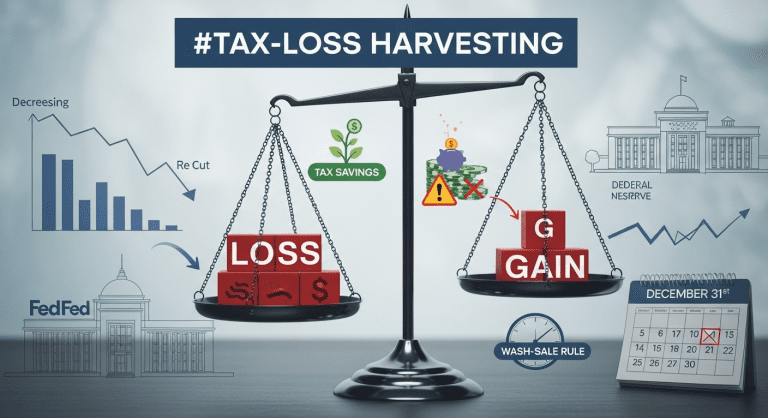

Featured snippet: Tax-loss harvesting is a powerful year-end strategy where investors sell losing investments to offset capital gains, thereby reducing their tax liability before December 31st. With only two months left in 2025, now is the perfect time to review your portfolio and act swiftly to maximize tax savings and strengthen your financial plan.

This October 31st, as we enter the homestretch to close out the year, tax-loss harvesting stands out as one of the best ways to lower your taxable investment gains for 2025. With financial markets reacting to recent Federal Reserve rate cuts, market volatility, and widespread efforts toward year-end financial planning, investors have a golden opportunity to optimize their tax bill and set the stage for stronger future returns.[5]

What Is Tax-Loss Harvesting?

Tax-loss harvesting means selling investments that have decreased in value since you bought them. By realizing these capital losses, you can offset profits from winning investments, potentially reducing your overall capital gains tax. If your losses exceed your gains, you can deduct up to $3,000 USD (or relevant national limits) from your yearly income, with the remainder carried forward for future years.[5] This approach is a staple for savvy investors, especially as December 31st approaches.

Why Tax-Loss Harvesting Matters Right Now

- High market volatility in 2025 provides more opportunities to harvest losses on individual stocks, mutual funds, and ETFs.

- The recent Federal Reserve rate cuts have changed asset valuations and created portfolio rebalancing opportunities.[1][5]

- October is Financial Planning Month, making strategic moves before year-end both popular and practical.[5]

- Time is of the essence—transactions must be completed before December 31 for tax benefits in this year.

How Tax-Loss Harvesting Works: Simple Example

Suppose you bought shares of a tech ETF at $80, now worth $60. By selling those shares now, you lock in a $20 per share capital loss. If you also sold an AI stock at a $1,000 gain, your loss offsets that gain, and you only pay tax on the net profit ($1,000 minus total losses).

Tax-Loss Harvesting Step-By-Step

- Review your gains and losses: Pull up your brokerage account and identify positions with unrealized losses.

- Sell securities with losses: Prioritize assets you’re comfortable parting with, especially those unlikely to recover soon.

- Offset gains: Use the realized losses to counterbalance capital gains from sales you’ve already made (or plan to make).

- Track the $3,000 rule: Deduct up to $3,000 USD in net losses from ordinary income for the current year; excess losses roll over.

- Stay aware of rules: Mind the wash-sale rule, which prevents you from buying the same or similar security within 30 days and still claiming a tax loss (more on this below).

Crucial Tax-Loss Harvesting Rules and Mistakes to Avoid

The Wash-Sale Rule Explained

The wash-sale rule is essential for successful tax-loss harvesting. If you sell a stock, ETF, or mutual fund for a loss and buy “substantially identical” securities within 30 days before or after the sale, the IRS disallows the loss. This means you can’t immediately repurchase the same position—be sure to wait at least 31 days, or consider buying a similar security that’s not “substantially identical.”

For example, selling “Tech ETF A” and buying “Tech ETF B” from a different provider may comply with the rule, while selling and re-buying the exact ETF would not.

Tax-Loss Harvesting in Different Accounts

- Taxable Brokerage Accounts: All tax-loss harvesting benefits flow through here.

- Retirement Accounts (IRA, 401k): No tax-loss harvesting allowed, since gains/losses are tax-sheltered.

- International investors: Rules and limits may vary. Always check local tax laws or consult a tax advisor.

Tax-Loss Harvesting Across Asset Classes: Stocks, ETFs, and Mutual Funds

Investors can apply tax-loss harvesting to a wide range of investments:

- Individual Stocks: Opportunities arise from recent market drops, tech sector rotations, or disappointing earnings.

- ETFs and Mutual Funds: These often provide more flexibility for swapping into similar funds to avoid the wash-sale trap.

- Cryptocurrency: Unlike stocks, current IRS rules do not recognize wash-sale restrictions for digital assets (as of 2025). However, legislation is subject to change; monitor updates diligently.

Recent Fed Rate Cuts: New Opportunities in 2025

2025 has seen multiple Federal Reserve rate cuts—bringing the benchmark rate to 3.75%–4.00% by October.[1][5][8] This shift has altered market dynamics, reshuffled asset prices, and increased volatility. Lower rates can mean softer bond yields, increased movement in equities and other assets, and more chances for investors to rebalance portfolios and harvest strategic losses before rates stabilize.[1][5][8]

- Markets are showing higher optimism, but certain sectors (like tech and AI) have remained volatile, opening new harvesting possibilities.

- Check recent performance against earlier purchases—some of your holdings may offer ideal harvesting points thanks to market turbulence.

Tax-Loss Harvesting for Investors in the US, Canada, UK, and India

- United States: Classic $3,000 annual income offset, with unlimited capital loss carry-forward.

- Canada: Losses first applied against gains and then carried back or forward to other tax years.

- UK: Capital losses offset gains, with detailed annual reporting.

- India: Short-term and long-term losses may offset corresponding capital gains, with setoff and carry-forward rules up to 8 years.

It’s wise to consult a reliable tax expert or financial planner in each country—rules and allowances vary by jurisdiction.

Ready for Year-End Tax Optimization? Three Actionable Tips

- Act swiftly: Market conditions can change rapidly, and December 31 is the final cutoff for 2025 tax-loss harvesting benefits.

- Document transactions: Maintain clear records of buys, sells, and replacement securities to prove compliance with tax rules.

- Check with advisors: Tax-loss harvesting is powerful, but mistakes (especially with wash-sale rules) can be costly. Consulting an expert is often worth it.

Final Thoughts: Why Tax-Loss Harvesting Belongs in Your Financial Toolkit

Tax-loss harvesting is one of the easiest ways for investors to save meaningful money each year. As markets react to Federal Reserve rate cuts and year-end financial planning surges, savvy investors see now—late October and early November—as the smartest window to review their portfolios, capture allowable losses, and lock in lower tax bills for 2025. With just weeks left in the year, acting promptly can mean more money in your pocket and a stronger investment outlook.

For deep dives and additional resources, consider consulting Investopedia’s guide to tax-loss selling or official IRS tax resources. This year, a little portfolio clean-up could mean a much brighter financial future.

Disclaimer: This article is for informational purposes only. Always consult with a qualified tax professional before making investment decisions that affect your tax liability.

0 Comments