Complete Guide to Building a Strong Emergency Fund for Young Adults in the USA

Are you prepared for unexpected financial setbacks? An emergency fund is your financial safety net that can help you navigate life’s surprises without falling into debt. This guide provides you with step-by-step strategies to build, grow, and maintain a robust emergency fund tailored specifically for young adults in the USA. Whether you’re just starting out or looking to reinforce your financial security, understanding the fundamentals is crucial for long-term stability.

What is an Emergency Fund and Why Is It Important?

An emergency fund is a dedicated savings account used exclusively for unforeseen expenses, such as medical emergencies, car repairs, or job loss. For young adults in the USA, establishing this fund is vital because it offers peace of mind, reduces financial stress, and prevents reliance on high-interest debt solutions like credit cards or payday loans.

Studies show that many Americans are unprepared for financial emergencies, which can result in spiraling debt. Building an emergency fund early can help you stay financially resilient and achieve your broader financial goals with confidence.

How Much Should You Save in Your Emergency Fund?

Standard Recommendations

Most financial experts suggest saving enough to cover 3 to 6 months of living expenses. For example, if your monthly expenses total $2,000, aim for a fund of $6,000 to $12,000.

Consider Your Personal Circumstances

- Employment Stability: If you have a stable job, lean toward the lower end of the spectrum.

- Income Variability: If your income fluctuates, aim for 6 months or more.

- Dependents and Responsibilities: More dependents mean a larger safety net.

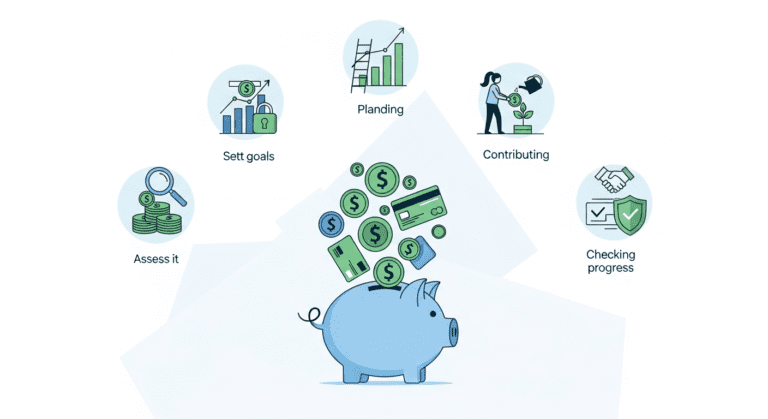

Steps to Build Your Emergency Fund

1. Set Clear Savings Goals

Determine your target amount based on your expenses and personal situation. Break it down into monthly savings goals to stay motivated.

2. Create a Budget and Identify Savings Opportunities

Analyze your income and expenses. Look for areas where you can cut back, such as dining out, subscriptions, or impulse spending. Redirect those savings into your emergency fund.

3. Choose the Right Savings Account

Select a high-yield savings account with easy access and no withdrawal penalties. This maximizes your interest earnings while keeping funds accessible during emergencies.

4. Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund. Automating ensures consistent contributions and reduces temptation to skip deposits.

5. Increase Contributions Over Time

Whenever possible, increase your savings rate—whether through raises, bonuses, or additional income sources like side hustles (see our side hustle tips).

Common Mistakes to Avoid

- Using your emergency fund for non-emergencies — only tap into it during genuine crises.

- Not updating your fund — revisit your target as expenses and income change.

- Keeping funds in low-interest accounts — choose high-yield options to maximize growth.

Maintaining and Growing Your Emergency Fund

Once you’ve built your emergency fund, focus on maintaining its size. Replenish it after use promptly, and aim to increase the fund as your expenses grow or life circumstances change.

Regularly review your financial plan and consider whether your emergency fund coverage remains adequate. Keep an eye on inflation and increased costs to adjust your savings goals accordingly.

External Resources for Your Financial Journey

- Step-by-step guide to building an emergency fund

- Simple budgeting for young adults

- Federal Reserve’s advice on emergency savings

Frequently Asked Questions (FAQs)

1. How can I save faster for my emergency fund?

Set up automatic transfers, cut unnecessary expenses, and look for extra income sources like freelance work or selling unused items.

2. Is it better to keep my emergency fund at a bank or invest it?

For quick access and safety, a high-yield savings account is best. Investments may offer higher returns but are less accessible in emergencies.

3. How long does it typically take to save 3-6 months of expenses?

This depends on your income and savings rate. For example, saving $500 per month can take anywhere from 6 to 12 months to reach your goal.

4. Can I use my emergency fund for medical expenses?

Yes, medical emergencies are common reasons for needing an emergency fund. Use it solely for urgent needs to maintain financial stability.

5. How often should I review my emergency fund?

At least once a year or after major financial changes, such as a new job, relocation, or significant expenses.

Conclusion and Key Takeaways

Establishing an emergency fund is one of the most important steps young adults in the USA can take towards financial independence. By setting clear goals, automating savings, and avoiding common pitfalls, you can create a safety net that offers peace of mind during unexpected events. Remember, consistency and discipline are key — your future self will thank you.

Actionable Tips:

- Start small — even $500 can make a difference.

- Automate savings to stay consistent.

- Revisit your goals periodically and adjust as needed.

- Reserve your emergency fund strictly for emergencies.

- Utilize high-yield savings accounts for better growth.

Building a robust emergency fund may take time, but every dollar saved is a step toward greater financial security. For more tips on managing your personal finances, explore our personal finance section.

0 Comments