Ultimate Guide to Debt Consolidation in the UK: Steps, Benefits, and Mistakes to Avoid (2024)

Are multiple debts making your monthly finances a headache? Many UK adults in their 31-40 age group struggle to keep up with high credit card bills, loans, and overdrafts, feeling trapped in an endless repayment cycle. Here’s the good news: debt consolidation could be your path to a simpler, less stressful financial future. This comprehensive guide will demystify debt consolidation in the UK—explaining how it works, what to watch for, and actionable steps to start today.

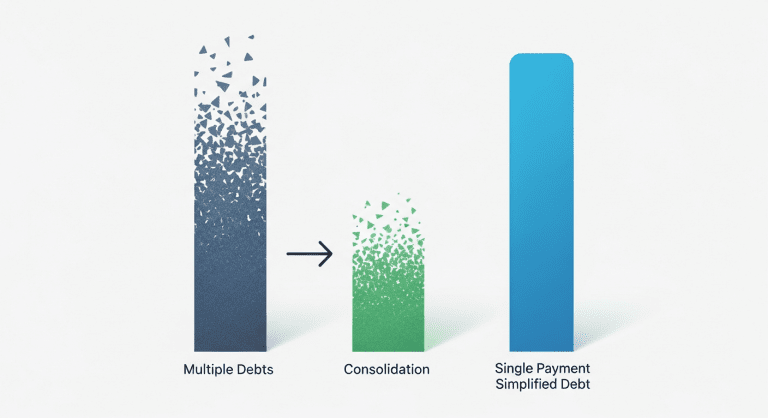

What Is Debt Consolidation?

Debt consolidation means combining multiple debts—like credit cards, overdrafts, and personal loans—into one single monthly payment. In the UK, this is often done by taking out a new loan or using a balance transfer credit card to clear all existing balances. The goal? Simplify repayments, reduce stress, and (potentially) save money on interest.

- One payment, one interest rate—streamlines your budget

- Clear end date—know exactly when you’ll be debt-free

- Lower monthly costs—when done right

Is Debt Consolidation Right for You?

Debt consolidation isn’t for everyone. It’s most effective if you:

- Have multiple debts (especially unsecured ones like cards or loans)

- Can qualify for a lower interest rate than your current debts (check your options)

- Have a steady income and fair-to-good credit score

- Are struggling to stay on top of multiple repayments

Not sure where to start? Try a financial check-up—this guide can help: How to Do a Midyear Money Check-In: Step-by-Step.

How to Consolidate Debts in the UK (Step-by-Step Guide)

1. List Your Current Debts

- Loan amounts (e.g. credit cards, overdrafts, store cards, payday loans)

- Current interest rates and minimum payments

- Total monthly outgoings

Why: You need a clear picture to compare new consolidation options and ensure they’re genuinely saving you money.

2. Check Your Credit Score

- Use free UK services like Experian, Equifax, or TransUnion

Tip: A better credit score unlocks lower interest rates, so check for errors and look for quick improvements.

3. Research Debt Consolidation Options

- Personal Loan: Most common, especially for 31–40-year-olds in the UK. Banks, building societies, and online lenders offer these.

- Balance Transfer Credit Card: Best for mainly credit card debts—look for 0% balance transfer deals (just watch fees and time limits).

- Debt Management Plan (DMP): Set up by charities if you can’t get new credit (not technically consolidation, but helps streamline payments).

4. Compare Your Repayment Costs

When comparing loans/cards:

- Monthly payment amount

- Total interest cost (£)

- Loan length (months/years)

- Any fees (setup, transfer, early repayment, etc.)

Important: Use free calculators (like the StepChange one) to see true savings.

5. Apply—and Pay Off Old Debts Immediately

- Apply for your chosen loan/card (soft search first to avoid harming your credit)

- Use new funds immediately to pay off all specified debts

- Set up a direct debit for your new single payment

6. Destroy Old Cards (And Don’t Rack Up New Debts!)

This step trips up many UK adults. Cut up your old cards or reduce limits; avoid temptation to use them again.

Biggest Mistakes to Avoid with Debt Consolidation

- Borrowing more than you need (tempting, but leads to more debt over time)

- Not checking for hidden fees (balance transfer cards often have 2–5% fees)

- Missing payments on your new loan (hurts your credit and cancels any advantage)

- Running up new debt after consolidating

- Assuming consolidation = lower cost; always check total interest paid

Want more ways to build smart financial habits? Read: Simple Budgeting for Young Adults: 7 Steps to Own Your Money.

Benefits of Debt Consolidation for UK Adults (31-40)

- Easier to manage—one payment date, less confusion

- Potential interest savings, especially if you’re rolling high-interest credit cards into a lower-rate loan

- Motivation boost: seeing debts shrink faster

- Better credit rating long-term, if you stick to payments

- Reduced stress and improved mental wellbeing

Drawbacks to Watch Out For

- Some loans require homeowner status (secured loans); risk losing your home if you default

- Longer-term loans may cost more in total interest, even with lower monthly payments

- Lenders may refuse a consolidation loan if your credit history is poor

- If you use new credit or miss payments, you could end up worse off

Alternatives and When to Get Help

- Try a Debt Management Plan: Managed by a debt charity if you can’t get a loan

- Snowball Method: Pay the smallest debt first to gain momentum

- Avalanche Method: Pay off debts with the highest interest rates first

- Seek free advice from specialists: Citizens Advice, StepChange, or National Debtline

For more on building lasting financial confidence, explore: Ultimate Morning Routine Guide for Young Adults: Boost Productivity & Achieve Success.

Practical Example: Debt Consolidation in Action

| Before | After Consolidation |

|---|---|

|

|

FAQs: UK Debt Consolidation for Adults 31–40

Is debt consolidation bad for your credit score?

Initially, applying for new credit causes a small dip. But if you make payments reliably, your credit score can improve over time.

Should I use a secured or unsecured loan?

Unsecured is often safer (no property risk). Only consider secured loans (like homeowner loans) if you are confident in repayments, as your house could be at risk.

Can you consolidate ‘bad credit’ debts?

It’s harder, but possible. Specialist lenders will charge higher interest. Alternatively, a Debt Management Plan may suit your situation.

Are balance transfer cards really interest-free?

Only for a set period (usually 12–30 months), after which standard rates apply. Always check transfer fees and make sure you pay off the balance in time.

What if debt consolidation isn’t possible?

Speak to a UK debt charity for tailored help. There are other debt relief options beyond loans.

Conclusion: Take Control of Your Debt Today

Debt consolidation can be a smart step for UK adults aged 31–40 drowning in high-interest debts. Done right, it can cut your costs, simplify your lifestyle, and boost your confidence. But always compare deals, avoid common pitfalls, and stay disciplined with your spending habits. For extra guidance on mastering your money mindset, check out our related articles below.

- How to Do a Midyear Money Check-In

- Simple Budgeting for Young Adults

- Morning Routine for Productivity

For further advice, consult trusted resources like StepChange, Citizens Advice, and MoneyHelper.

0 Comments