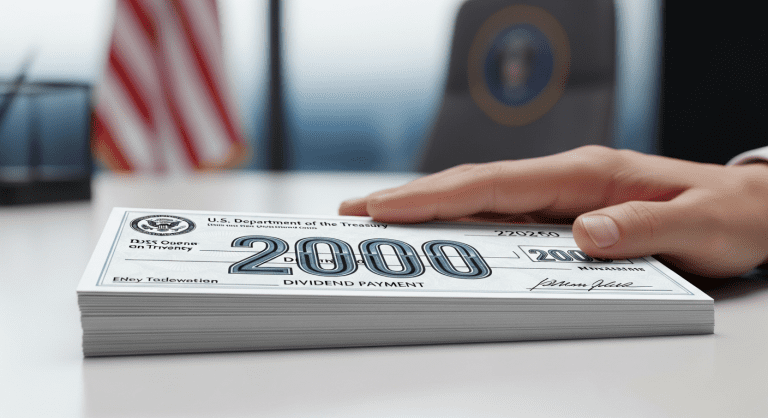

Trump Tariff Dividends: Will $2,000 Tariff Checks for Americans Really Happen in 2026?

The idea of Trump tariff dividends—potential $2,000 checks for millions of middle- and lower-income Americans—has sent ripples through the economic and political landscape in 2025 and 2026. With new tariffs bringing in record amounts of revenue, questions are swirling: will these “tariff dividend” checks arrive before the 2026 elections? How might they impact your wallet, the broader economy, or the nation’s debt? And what does the ongoing Supreme Court review of Trump tariffs mean for their future?

This article covers everything you need to know about the Trump $2,000 tariff dividend checks. We’ll break down the latest news, answer top questions, compare pros and cons, and provide key analysis for voters, market watchers, and anyone interested in U.S. fiscal or trade policy.

For more on this year’s finance trends, check out 2025 Finance Trends for Young Adults.

What Are Trump Tariff Dividends?

Trump tariff dividends refer to a proposed plan to rebate money collected from U.S. import tariffs directly back to most Americans. Inspired by the COVID-19 stimulus checks, former President Donald Trump announced in late 2025 that his administration aims to send out $2,000—or more—per person to adults and children in households earning under $100,000 (high earners excluded). Any leftover tariff revenue would go toward reducing the national debt.

Key Announcement Timeline

- July 2025: First floated in public remarks and interviews.

- Nov. 10, 2025: Truth Social post promising “at least $2,000 a person” before mid-2026.

- Jan. 2026: White House advisors confirm possible 2026 issuance, aiming for the midterm cycle.

If enacted, it could mean direct payments before the next election—a move likely designed to boost popularity among middle-income voters grappling with rising living costs.

How Does the Tariff Dividend Work?

The proposal relies on redirecting tariff revenue—money collected from import taxes—to American households. Trump’s new global tariffs, imposed under the 1977 International Emergency Economic Powers Act effective April 2, 2025, have already generated about $100 billion and are projected to bring in $300 billion per year if sustained.

The core structure:

- Eligibility: Households with income under $100,000.

- Amount: $2,000 per person (adults and children included).

- Payout Frequency: Details are fluid; every-other-year payments could become revenue-neutral around 2027 if all tariffs remain.

- Legislation: Several bills, including Sen. Josh Hawley’s American Worker Rebate Act (checks $600-2,400 per family), have been floated but not passed yet.

Secondary and Related Keywords

- Trump $2,000 tariff dividend checks 2026

- Tariff revenue rebates middle income Americans

- Supreme Court Trump tariffs legality dividends

- Tariff dividend prospects 2026

- Tariff rebate impact on debt

Legal, Economic and Political Risks Explained

The Trump tariff dividends plan faces serious hurdles before anyone sees a check. Here’s what you need to know:

1. Supreme Court Challenges

Major retailers and importers, including Costco, are suing for tariff refunds, claiming Trump’s tariff powers are overreaching. The case is pending before the Supreme Court. If the Court finds most tariffs illegal, the revenue for future dividends could shrink or disappear.

See the CRFB’s Tariff Dividend Analysis for ongoing litigation details.

2. Fiscal Impact: Cost vs. Revenue

- Sending $2,000 to every qualifying American would cost about $600 billion per round, according to the Committee for a Responsible Federal Budget (CRFB).

- Annual checks of $2,000 would increase the national deficit by roughly $6 trillion over a decade—double the revenue raised by the tariffs themselves.

- Even distributing checks every other year would only become revenue-neutral around 2027, assuming tariffs remain legal and fully in place.

3. Economic Impacts: Winners, Losers, and Side Effects

- Tariffs have raised import costs for businesses and consumers—especially in manufacturing and supply chains—but haven’t triggered major inflation yet due to strong GDP (2.5–3% growth in 2025).

- Trade has shifted away from China and U.S. allies toward Mexico and Southeast Asia, causing supply chain headaches for some sectors.

- Checks could offer quick relief for families but risk fueling future inflation or weakening the U.S. dollar if debts mount and tariffs trigger global retaliation.

4. Politics of Payout Timing

Timing is everything. White House insiders say rebates could drop ahead of the 2026 midterms—a potential game-changer for voter enthusiasm. Fiscal hawks, however, warn this could be a “populist sugar rush” that leaves America with “trillions in new red ink.”

Explore more big political moments in our coverage of 2025’s major revelations.

Pros and Cons: Should You Welcome a Tariff Dividend Check?

| Pros | Cons |

|---|---|

| Direct relief for those hit by higher import costs | Drains revenue that could reduce ballooning debt |

| Populist appeal—money in voters’ pockets | May fuel inflation or raise import prices further |

| Could stimulate the economy before an election | Uncertainty over Supreme Court and legal risk |

| Demonstrates “America First” trade strategy in action | Potential for international retaliation and weakened trade positions |

The Debt Dilemma: Can America Afford More Direct Payments?

America’s deficit is already approaching $2 trillion per year, with national debt climbing toward record highs. Experts warn the debt-to-GDP ratio could reach 127–134% by 2035 if large, unfunded rebates become the norm.

For more on managing personal and national finances, visit our guide to the 50-30-20 budget rule for young adults.

Will This Move the Economy—or Just the Ballot Box?

The Trump tariff dividends proposal is as much about politics as policy. For some, it’s overdue help as the cost of living rises. For others, it’s a risky bet on fiscal discipline and America’s long-term economic security.

What’s Next? 2026 Outlook for Tariff Dividend Checks

- Supreme Court Decision: The biggest wildcard—if the justices rule tariffs illegal, massive refunds could be owed, and future dividends would be off the table.

- Midterm Election Calendar: All eyes on pre-election timing for political impact.

- Congressional Action: Watch for new legislation, amendments, and negotiations that could alter eligibility, amounts, or frequency.

- Market Watch: Investors and import-dependent businesses remain cautious as tariff policy—and U.S. dollar strength—hang in the balance.

FAQs About Trump Tariff Dividend Checks

Will I really get a $2,000 tariff check in 2026?

It’s possible but uncertain. The administration wants to send rebate checks, but Supreme Court challenges and fiscal pushback could delay or reduce payments.

Who would qualify for the Trump tariff dividends?

The current proposal covers households making under $100,000, including adults and children. High-income earners are excluded.

How often would the tariff checks be sent?

Officially, it’s under debate. Annual payments would add trillions to the debt, while every-other-year checks could be revenue-neutral by 2027—if all tariffs stick.

What if the Supreme Court blocks Trump’s tariffs?

If the tariffs are ruled illegal, there won’t be enough revenue for future dividends. Businesses may also receive retroactive refunds.

What impact could these checks have on inflation and debt?

Direct payments could offer relief but risk increasing the deficit and possibly stoking future inflation, especially if the nation’s debt grows unchecked.

Conclusion: Tariff Dividends—Windfall or Worry?

Trump tariff dividends represent one of the boldest new approaches to trade and fiscal policy on the national stage—offering big immediate gains to many households but with undeniable long-term risks. Whether you see this as timely relief or potential economic overreach may depend on where you sit: worried consumer, fiscal hawk, or political strategist.

- Keep watch for Supreme Court decisions and new legislative moves.

- Consider both short-term relief and long-term consequences for national debt and inflation.

- Stay informed through authoritative resources like the Committee for a Responsible Federal Budget and the Policy Center.

For those tracking the intersection of politics, global economics, and personal finance, the Trump tariff dividend saga is a must-watch in 2026.

Keep building your money skills with our Young Adults’ 2025 Consumer Finance Trends Guide.

0 Comments