India’s New Baggage Rules 2026: Everything You Need to Know About Duty-Free Gold Jewellery and Travel Allowances

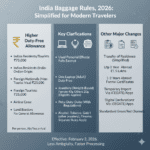

India’s **Baggage Rules, 2026**, introduced effective February 2, 2026, mark the first major update in over a decade, transforming customs allowances for international travelers entering India by air or sea. With higher duty-free limits, simplified procedures, and clear standards, these rules aim to ease travel stress, boost the jewellery sector, and enhance transparency. Whether you’re an NRI, a frequent flyer, or a jewelry enthusiast, understanding these changes is crucial for a hassle-free experience.

Overview of the New Baggage Rules 2026

The government announced these revised customs rules during the Union Budget 2026, with Finance Minister Nirmala Sitharaman signaling a significant shift towards traveller-friendly policies. The rules, notified by the Central Board of Indirect Taxes and Customs (CBIC), introduce higher allowances and streamlined processes, reflecting inflation and increased international travel volume, projected to reach 350 million air passengers by 2028.

Key Changes in Duty-Free Allowances

General Goods Duty-Free Limits

- ₹75,000 for Indian residents, Indian-origin tourists, or foreign nationals on non–tourist visas (up from ₹50,000)

- ₹25,000 for foreign tourists (up from ₹15,000)

- ₹2,500 for crew members

These limits aim to reduce confusion and facilitate quicker clearance at airports, especially for frequent travelers and NRIs returning home.

Jewellery Allowances

One of the most notable updates is the new weight-based jewelry allowance, replacing value-based caps:

- 40 grams of gold/silver/platinum jewellery for females

- 20 grams for males and others

This applies to Indian residents or Indian-origin tourists returning abroad for over a year, carried in bona fide baggage for personal use. It simplifies previous value-based limits, making personal imports easier and less confusing. For example, a woman can now carry 40 grams of gold jewellery duty-free, whether or not its current market value exceeds a specific amount.

Additional Perks and Exclusions

- One new laptop duty-free for passengers aged 18 or above (excluding crew)

- No pooling of allowances—each passenger gets individual limits

- Excludes sin goods such as excess alcohol, tobacco, firearms, TVs, and other restricted items

These enhancements are designed to promote electronic declarations, faster clearance, and transparency at entry points.

Why Are These Changes Important?

The overhaul is a significant step toward improving the ease of travel, especially for NRIs and Indian-origin travelers abroad, such as those in the UAE, who frequently return with gifts or personal goods. Additionally, the increase in duty-free limits supports the boosting of India’s gems and jewellery sector, which has seen tariff cuts from 20% to 10-18%, aiming to increase exports and domestic demand.

Impact on Travel and the Jewellery Sector

These relaxed allowances reduce airport stress, cut down secondary inspections (already decreased by approximately 20% at major airports like Delhi and Mumbai), and build confidence among travelers. The rules are also aligned with rising global travel trends, making India a more attractive destination for international tourists and NRIs planning to bring back valuable personal belongings without hefty duties.

What This Means for Passengers

If you’re returning to India, here’s what to keep in mind:

- Carry jewelry within the 40g (women) or 20g (men) limits to avoid duty charges.

- Declare goods worth up to ₹75,000 duty-free, higher than previous thresholds.

- Bring a new laptop duty-free if you’re above 18, without worrying about allowance pooling.

- Be aware of excluded items like excess alcohol, firearms, or larger TVs.

Proper understanding and adherence will help prevent delays and surprises at customs.

FAQs About India Duty-Free Gold Jewellery Baggage Rules

How much gold jewellery can I carry duty-free to India in 2026?

Women can carry up to 40 grams of gold, silver, or platinum jewellery duty-free, while men and others are allowed up to 20 grams.

What is the new duty-free limit for goods in India?

The duty-free allowance is now ₹75,000 for residents, tourists, and Indian-origin travelers on non-tourist visas, and ₹25,000 for foreign tourists.

Are there any items that are excluded from these allowances?

Yes, items like excess alcohol, tobacco, firearms, and large electronics such as TVs are excluded from duty-free limits and require declaration or duty payment.

Can I pool allowances with family members?

No, each passenger has individual allowances; pooling is not permitted under these new rules.

Do these rules apply to arrivals via land borders?

No, they specifically apply to arrivals by air and sea, excluding land border crossings.

Summary and Actionable Takeaways

- Understand the new duty-free limits—₹75,000 for general goods, 40g gold jewellery for women.

- Declare goods clearly; maintain receipts if carrying high-value items.

- Carry only allowed quantities to avoid duty charges and delays.

- Use electronic declaration facilities to expedite clearance.

- Stay updated on excluded items and specific allowances for personal use.

Conclusion

The updated **India Baggage Rules, 2026**, represent a significant, positive shift in customs policies. By increasing duty-free limits, simplifying procedures, and clarifying jewellery allowances, India is making international travel more convenient and encouraging the growth of the jewellery sector. Whether you’re returning as an NRI, tourist, or business traveler, understanding these new rules is essential for a smooth journey.

For further details, check the official CBIC updates or visit trusted sources like Gulf News or Economic Times.

Safe travels and enjoy the benefits of the new customs regime!

0 Comments