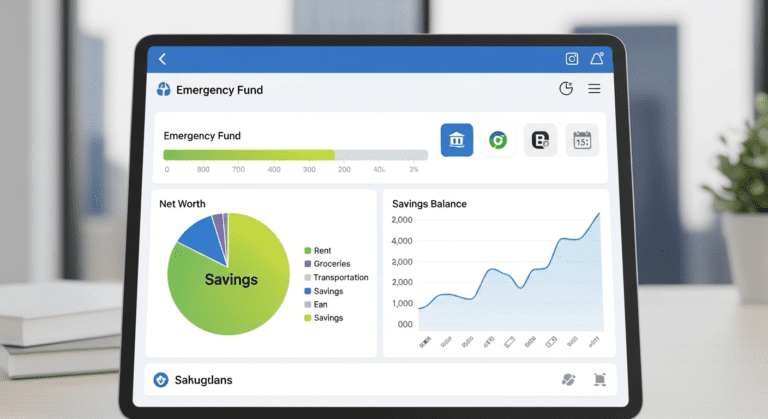

Complete Guide to Building an Emergency Fund for Young Adults in the USA

Are you a young adult aged 23-30 in the USA wondering how to secure your financial future? Building an emergency fund is a crucial step toward financial independence and peace of mind. This comprehensive guide will show you how to create, grow, and maintain an emergency fund that can protect you during unexpected financial crises.

What Is an Emergency Fund and Why Is It Important?

An emergency fund is a dedicated savings account designed to cover unforeseen expenses, such as medical emergencies, job loss, or urgent home repairs. Having a robust emergency fund can prevent you from resorting to high-interest debt and provide stability in turbulent times.

For young adults, especially those just starting their careers in the USA, establishing this fund is essential for:

- Reducing financial stress

- Protecting long-term investments

- Ensuring financial resilience during downturns

How Much Should You Save for Your Emergency Fund?

Recommended Savings Targets

Most financial advisors recommend saving enough to cover 3 to 6 months of living expenses. For example, if your monthly expenses are $2,000, your target should be between $6,000 and $12,000.

Factors Affecting Your Goal

Your personal situation influences this amount. Consider:

- Your job stability

- Monthly expenses

- Your income variability

- Dependents or liabilities

Steps to Build Your Emergency Fund Effectively

1. Assess Your Financial Situation

Analyze your current income, expenses, and debts. Use tools like this step-by-step guide for clarity.

2. Set a Realistic Monthly Savings Goal

Decide how much you can allocate monthly, even if small. Starting with $50 or $100 per month is better than nothing.

3. Open a Separate Savings Account

Choose a high-yield savings account to keep your emergency fund separate and earn interest. Look for institutions with no fees, such as online banks.

4. Automate Your Savings

Set up automatic transfers from your checking to savings account to ensure consistency and reduce temptation to spend.

5. Prioritize and Adjust

If you’re paying off high-interest debts, balance debt repayment with building your fund. Adjust goals as your income increases or expenses change.

Common Mistakes to Avoid

- Waiting too long to start saving

- Saving in a low-interest or easily accessible account with fees

- Trying to save too much too quickly and causing financial strain

- Using emergency funds for non-emergencies

Tips to Accelerate Your Emergency Fund Growth

- Increase income with side gigs or freelance work. Explore popular side hustles.

- Reduce unnecessary expenses by budgeting more effectively. Check out simple budgeting tips.

- Use windfalls, bonuses, or tax refunds to boost your savings.

- Set milestones and celebrate small victories to stay motivated.

FAQs About Emergency Funds for Young Adults in the USA

What is the best account for an emergency fund?

High-yield savings accounts, especially online banks that offer no fees and better interest rates, are ideal for emergency funds.

How long does it take to save $6,000?

It depends on your savings rate. Saving $200 monthly takes roughly 2.5 years. Automating savings helps reach your goal faster.

Can I use my emergency fund for other expenses?

It’s recommended to reserve your emergency fund strictly for genuine emergencies like medical issues, job loss, or urgent repairs. Using it for non-essentials can jeopardize your financial safety.

How often should I review my emergency fund?

Review your fund at least once a year or when your financial situation changes significantly, such as a new job or increased expenses.

Conclusion: Your First Step Toward Financial Security

Building an emergency fund is a vital yet manageable goal for young adults in the USA. Start small, stay consistent, and adjust as your income grows. An emergency fund not only provides peace of mind but also empowers you to make smarter financial decisions. Remember, the sooner you start, the sooner you’ll be prepared for life’s unexpected surprises.

Actionable Takeaways

- Assess your expenses and set a realistic savings goal.

- Open a separate high-yield savings account.

- Automate your monthly savings to stay consistent.

- Leverage side gigs or savings from windfalls to accelerate growth.

- Review and adjust your plan periodically.

For more insights on personal finance strategies, visit our latest finance trends.

0 Comments