Comprehensive Guide to Building a Powerful Emergency Fund for Young Adults in Australia

Are you a young adult in Australia looking to secure your financial future? A well-planned emergency fund is your first line of defense against unforeseen expenses. This guide provides a step-by-step approach to help you build an emergency fund that offers peace of mind and financial stability. Whether you’re just starting out or looking to improve your current savings, this article covers everything you need to know.

What Is an Emergency Fund and Why Is It Crucial?

An emergency fund is a dedicated savings pot designed to cover unexpected costs such as medical emergencies, car repairs, job loss, or urgent bills. For young adults in Australia, having this safety net is essential to avoid reliance on high-interest debt or disrupting your financial goals.

Studies show that many Australians lack sufficient savings to cover standard emergencies, putting them at risk of financial hardship. Building a robust emergency fund can shield you from these risks and enhance your financial resilience.

How Much Should You Save in Your Emergency Fund?

Standard Recommendations

- Most financial experts suggest setting aside 3 to 6 months of living expenses.

- This amount should cover essentials like rent, utilities, groceries, transportation, and insurance.

Adjustments for Your Lifestyle

- If you’re a freelancer or work in a volatile industry, aim for closer to 6 months.

- For stable employment, 3 months might suffice initially, with plans to grow savings over time.

To determine your target, calculate your monthly expenses and multiply by the desired months of coverage.

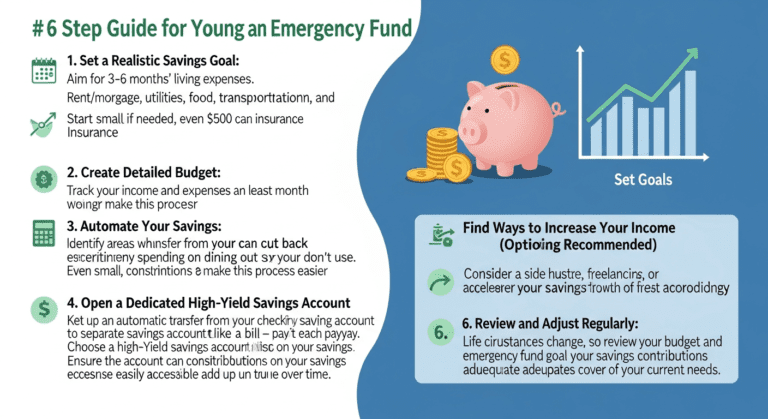

Step-by-Step Guide to Building Your Emergency Fund

1. Set Clear Goals and Timeline

Decide how much you want to save and by when. Break it into smaller milestones like saving $1,000 in 3 months.

2. Open a Dedicated Savings Account

Choose a high-interest savings account or a separate account that’s easily accessible but not linked to your everyday spending account.

3. Automate Your Savings

- Set up automatic transfers from your paycheck or main account to your emergency fund.

- Start small, e.g., 10% of your income, and increase as your financial situation improves.

4. Cut Unnecessary Expenses

- Review your monthly spending and identify areas like dining out, subscription services, or entertainment that can be reduced.

- Redirect those savings into your emergency fund.

5. Increase Savings When Possible

- Use bonuses, tax refunds, or extra income to accelerate your fund.

- Keep focus on your goal to motivate consistent progress.

6. Avoid Temptation and Keep It Intact

Do not dip into your emergency fund unless it’s a true emergency. Keep your goal in mind to stay disciplined.

Tools and Resources to Accelerate Your Savings

- Budgeting apps like Pocketbook or MoneyBrilliant

- Financial calculators to project your timeline

- High-interest savings accounts offered by major banks in Australia

Common Mistakes to Avoid When Building Your Emergency Fund

- Not defining a realistic goal based on your expenses

- Failing to automate saving processes

- Using your emergency fund for non-emergencies

- Neglecting to review and adjust your goals periodically

FAQs on Emergency Funds for Young Australians

1. How long does it take to build an emergency fund?

Depending on your income and expenses, it can take from a few months to a year or more to reach your goal. Consistency and automation speed up the process.

2. Can I keep my emergency fund in an everyday transaction account?

It’s better to keep it separate in a high-interest savings account to prevent accidental spending while earning some interest.

3. What should I do if I need to access my emergency fund before it’s fully built?

Only withdraw for true emergencies. If you find yourself frequently needing to access it, reassess your savings goal or expenses.

4. Is it better to save for emergencies or pay off debt first?

Prioritize building a small emergency fund (around $1,000) before aggressively paying down debt, then aim for comprehensive coverage later.

5. How can I stay motivated to save?

Set clear milestones, track progress visually, and remind yourself of the security that a solid emergency fund provides.

Conclusion: Secure Your Future Today

Building an emergency fund is a fundamental step toward financial independence for young adults in Australia. It provides peace of mind, reduces stress, and safeguards against financial setbacks. By setting clear goals, automating savings, and avoiding common pitfalls, you can establish a reliable safety net that supports your long-term financial plan.

Start today, and you’ll thank yourself when the unexpected happens. Remember, a little effort now pays off in peace of mind tomorrow.

Actionable Takeaways

- Calculate your monthly expenses to set your savings target.

- Open a dedicated high-interest account for your emergency fund.

- Automate savings and review periodically.

- Cut unnecessary expenses to accelerate your goal.

- Stay disciplined and avoid dipping into the fund unless absolutely necessary.

Learn more about effective budgeting strategies at Simple Budgeting for Young Adults and Emergency Fund Building Guide.

0 Comments