“`html

Smart Budgeting Tips for 31-40 Year Old Adults in Germany: Your Complete 7-Step Guide

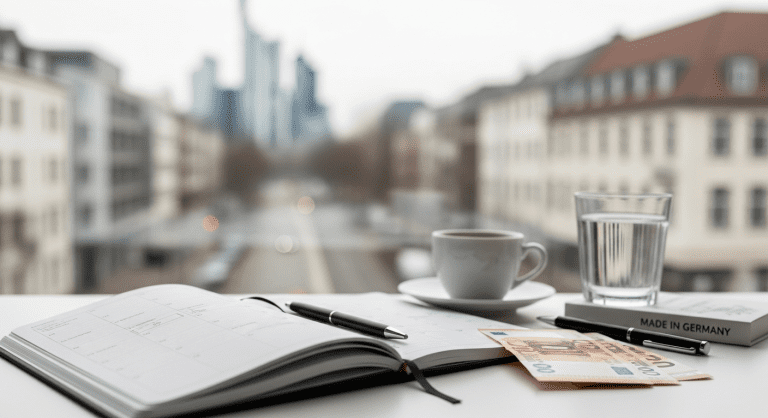

Managing money during your 30s can be challenging, especially when balancing career growth, family expenses, and future goals. This smart budgeting guide for adults aged 31-40 in Germany helps you create a clear, actionable plan aligned with German lifestyle and financial realities. You’ll learn how to optimize your budget, reduce expenses, and save efficiently while preparing for financial freedom.

Understanding Budgeting Needs for Adults 31-40 in Germany

Adults aged 31-40 typically experience higher income but also increased spending on family, housing, and retirement planning. This stage is crucial for setting a solid foundation for your future. Knowing how to budget effectively not only reduces financial stress but also empowers you to grow wealth steadily.

- 30s are peak earning years but with expanding financial obligations

- Importance of balancing daily expenses vs long-term saving

- Impact of inflation and living costs in Germany’s major cities

Primary Keyword: Smart Budgeting Tips for 31-40 Year Old Adults in Germany

Secondary Keywords:

- budget planning Germany adults

- financial tips 30s Germany

- family budgeting Germany

- saving strategies 31-40 years

- expense tracking tools Germany

LSI and Semantic Keywords:

- monthly budgeting tips German adults

- retirement saving Germany 30s

- living cost optimization Germany

- best budgeting apps Germany

- tax deductions for families Germany

- financial planning early 30s

- balancing mortgage and expenses

- debt management 30 year olds Germany

- emergency fund strategies

- long-term financial security

Step 1: Track Your Income and Expenses Accurately

Before creating a budget, you must have a clear view of all income sources and monthly expenses. Use popular and reliable expense tracking tools in Germany such as BudgetBakers or Monefy for precise tracking.

- Include all income: salary, freelance, rental income

- List fixed expenses like rent, utilities, insurance

- Track variable expenses: food, transportation, entertainment

- Review bank statements monthly to spot unnoticed expenses

Step 2: Prioritize Essential Expenses and Reduce Unnecessary Spending

Classify your expenses into essentials and non-essentials. In Germany, rent and health insurance take a significant part, so focus on optimizing these first. For example, check if switching local insurance providers or utilities can save monthly costs.

- Essentials: housing, food, transport, health insurance

- Non-essentials: dining out, subscriptions, impulse purchases

- Use price comparison portals like Verivox to find cheaper utility and insurance deals

- Create spending limits for discretionary categories

Step 3: Set Realistic Saving Goals for Short and Long-Term

Allocate a fixed percentage of your monthly income toward savings. A good benchmark for adults in their early 30s in Germany is to save at least 20% monthly. This should cover both emergency funds and retirement planning.

- Emergency fund = 3-6 months of essential expenses

- Retirement / pension supplemental savings through Riester or Rürup plans

- Short-term goals like travel, education, home purchase

- Adjust goals annually based on income changes

Step 4: Leverage Tax Benefits and Government Subsidies

Germany offers multiple tax deductions and benefits that can help lower your tax burden and increase disposable income. Understanding these is vital for anyone budgeting effectively in this age group.

- Claim work-related expenses (Werbungskosten) like travel and office supplies

- Use child allowances (Kinderfreibetrag) if applicable

- Contribute to Riester pension plans for government bonuses

- Utilize Swiss-German double tax treaties if applicable for cross-border workers

Learn more about tax benefits at the official German Finance Ministry site.

Step 5: Use Effective Budgeting Methods Suitable for 30s Adults

The 50/30/20 rule works well but tailoring it to your needs improves results. For example:

- 50% – essential living expenses

- 20% – savings and debt repayments

- 30% – lifestyle and miscellaneous expenses

If you have children or high mortgage payments, consider adjusting these percentages accordingly.

Step 6: Implement Monthly Financial Reviews and Adjustments

Consistency is crucial. Dedicate 30 minutes each month to review budgets, track progress, and make necessary changes.

- Check if savings goals are met

- Analyze overspending areas

- Plan for upcoming irregular expenses (car maintenance, holidays)

Step 7: Avoid Common Budgeting Mistakes to Stay on Track

Many adults in their 30s make avoidable errors such as ignoring inflation, neglecting insurance, or failing to automate savings. Avoid these pitfalls to ensure your budget lasts.

- Underestimating costs of raising children or emergencies

- Delaying retirement savings assuming it can wait

- Not maintaining an emergency fund separately from other savings

- Ignoring opportunities to refinance loans at lower interest rates

FAQs About Budgeting for Adults 31-40 Years Old in Germany

1. What is the best budgeting app for Germans in their 30s?

Apps like BudgetBakers and Monefy are popular due to German language support, bank sync, and expense categorization.

2. How much should I save monthly in my 30s?

Aiming to save at least 20% of your monthly income is recommended. This balances living costs and future needs.

3. Should I focus on paying off debt or saving first?

Prioritize paying high-interest debts. Simultaneously, build a small emergency fund to avoid more debt in emergencies.

4. How can I optimize taxes as a family in Germany?

Claim child-related tax allowances, deduct work expenses, and consider private pension schemes that provide tax benefits.

5. How often should I revisit my budget?

Monthly reviews are ideal to stay current with your financial situation and adjust for income or expense changes.

Conclusion: Take Control of Your Finances Today

Kicking off your smart budgeting journey in your 30s is a powerful step toward long-term financial stability. By tracking your expenses, setting realistic savings goals, utilizing German tax incentives, and consistently reviewing your budget, you’ll create a sustainable money management system. Remember, the best budget adapts to lifestyle changes and prepares you for both planned and unplanned expenses.

Start today with small, actionable steps to secure your financial future and reduce money stress in your 30s and beyond.

Internal Linking Suggestions

- Simple Budgeting for Young Adults

- Boost Your Gut Health Naturally (health affects financial productivity)

- How to Do a Midyear Money Check-In

- Inflation-Proof Budgeting in 2025

“`

0 Comments