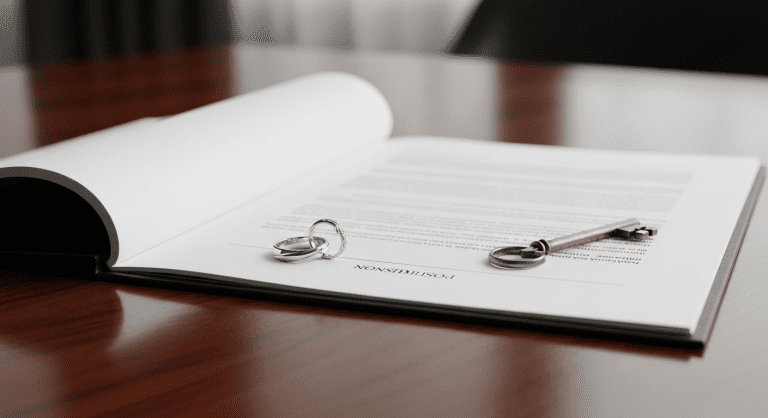

Postnuptial Agreement 2026: The #1 Money Move for Married Couples This Year

What if one simple document could protect everything you’ve worked for—your assets, your business, your peace of mind—in 2026? Amid rising divorce rates and looming economic uncertainties, experts urge couples to consider a postnuptial agreement as their top financial priority. This guide will explain postnuptial agreements for 2026, how they work, why they’re trending, who needs one, and the actionable steps to create real protection for your love and your legacy.

What Is a Postnuptial Agreement—and Why Now?

A postnuptial agreement (“postnup”) is a legally binding contract created by married couples after marriage. Unlike prenups, postnups define how assets, debts, spousal support, and even business interests will be handled if the marriage ends in divorce or death—no matter when you sign. For 2026, this financial shield matters more than ever due to:

- Economic volatility: Rapid changes since 2025—market swings, inflation, fluctuating interest rates, and new tax laws under a changing administration—put couples’ finances at serious risk.

- Rising divorce rates: Late 2025 saw a 15% spike in divorce filings (family court data), with couples citing money fights as the main cause over 70% of the time.

- High-profile divorce horror stories: From Jeff Bezos’ $38 billion split to countless entrepreneurs losing family businesses overnight, the headlines say it all—lack of protection can be devastating.

Creating a postnup is about taking back control—and turning anxiety into empowerment in uncertain times.

Core Benefits: Why Every Couple Needs a Postnup in 2026

- Asset protection: Shield personal and joint assets, business interests, and inheritances.

- Debt management: Clearly define who is responsible for existing or future debts.

- Clarity on spousal support: Set fair rules for alimony or financial support if things turn sour.

- Child and inheritance planning: Ensure children from previous relationships or future heirs are protected.

- Business continuity: Keep family businesses, LLCs, or startups secure—even through divorce.

According to certified divorce financial analyst Cathy Paretti, postnups often “prevent financial devastation—and heartbreak—when life doesn’t go as planned.”

How to Create a Postnup for Asset Protection in 2026: Step-by-Step Guide

- Talk openly with your spouse about financial fears, goals, and what you both want protected. Honest dialogue is key.

- List all assets, debts, and business holdings, including investments, real estate, retirement accounts, and any expected inheritances.

- Discuss specific terms: Who keeps what? How will debts be split? What about spousal support? Consider business ownership, too.

- Hire independent legal counsel for both partners. This is required in all 50 states for a postnup to be valid and helps avoid conflicts of interest.

- Draft and review the agreement with your lawyers, ensuring full disclosure and fairness.

- Sign and notarize the document in accordance with state laws.

- Update as needed after major life changes—like births, large inheritances, business growth, or sudden financial windfalls.

Completing a postnup by mid-2026 is especially wise as the year’s legislative and economic changes unfold.

For more practical tips on communication, visit 20 powerful communication techniques.

Postnup vs Prenup: Key Differences and Costs Explained

| Prenuptial Agreement | Postnuptial Agreement | |

|---|---|---|

| When created | Before marriage | Anytime after marriage |

| Primary uses | Asset division, debt protection, inheritance planning | Same as prenup + new assets, changed circumstances |

| Legal enforceability | High if properly executed | High (all 50 states) with full disclosure & independent counsel |

| Cost range | $1,500–$5,000+ | $2,500–$10,000+ (depends on complexity & state) |

| Ideal for | Newlyweds, first marriages | Entrepreneurs, career shifts, second marriages, major life events |

High earners, business owners, and blended families especially benefit from updated postnups as wealth and family structures change.

For more about relationship dynamics, see habits of couples that last.

Trending Now: Why Postnups Are Exploding in Popularity for 2026

Year-end financial planning always spikes after a busy, uncertain year—and late 2025 was no exception. Postnuptial agreements are trending for several reasons:

- More couples are getting married later, bringing established careers, businesses, and children from previous marriages with them.

- Social media is filled with cautionary tales: “My divorce cut my 401(k) in half!” “I lost my dream home overnight!”

- Legal organizations report postnups have surged since 2020.

- Many have seen changing tax laws, geopolitical tensions, and job market shifts, prompting urgent action.

Smart couples see a postnup not as a sign of mistrust, but a blueprint for security—and a trust-building conversation for the future.

Expert Insights: How a Postnup Fosters Security (and Peace of Mind)

Cathy Paretti, CDFA (20+ years in family law finance), shares: “The real value of a postnuptial agreement isn’t just legal—it’s emotional. Most couples breathe easier knowing they’re protected from financial disaster if the unthinkable happens.”

- Prevents late-night money arguments that erode trust and happiness.

- Makes handling unexpected events—like sudden illness or an economic downturn—much simpler.

- Helps families preserve businesses and generational wealth for children and grandchildren.

For more relationship wisdom, explore relationship tips that work.

Common Clauses to Consider in a 2026 Postnup

- Division of marital and non-marital assets

- Debt responsibility (including new debt)

- Spousal support/alimony terms

- Business ownership and control after separation

- Inheritance rights for children from previous or future relationships

- Guidelines for handling “life events” (relocation, illness, windfalls)

Review your agreement annually—or after any major change—to stay covered.

Postnup Myths vs. Reality

- Myth: Postnups are only for couples headed for divorce.

Reality: The best time to make one is when things are good. - Myth: They’re expensive or hard to enforce.

Reality: Well-written postnups (with full disclosure and counsel) are enforceable in all 50 states. - Myth: Talking about postnups means you don’t trust each other.

Reality: Open, honest discussion strengthens relationships.

People Also Ask: Postnuptial Agreement FAQs

Are postnuptial agreements enforceable in all states?

Yes—if created with full financial disclosure, independent legal counsel for both parties, and no coercion, they are legally binding in all 50 states.

How much does a postnup cost in 2026?

Simple postnups range $2,500–$5,000; complex estate or business protection can exceed $10,000. Legal fees vary by state and the complexity of your assets.

What happens if we update our postnup later?

You can fully revise or update your postnup as circumstances change—just follow the same legal steps and ensure both parties have independent counsel.

Can a postnup protect inherited or premarital assets?

Absolutely. A well-drafted postnup can outline which assets remain yours, no matter what the future brings, including future gifts or inheritances.

Do both spouses need their own lawyer?

Yes. To ensure fairness and validity, each spouse should have independent legal representation.

Is a postnup a sign of marital trouble?

No. Most couples create postnups when the relationship is stable, to reduce conflict and uncertainty later.

Conclusion: Protect Your Love, Your Wealth, Your Legacy!

The one critical move for couples in 2026: Create and sign a postnuptial agreement. With divorce rates and financial pressures on the rise, a postnup transforms fear into partnership, supporting both trust and wealth preservation.

- Secure your assets, your business, and your future retirement.

- Plan ahead for tax changes and market shifts with confidence.

- Start an open, empowering dialogue with your partner.

- Learn more about legal requirements or see why postnups are trending.

For further resources on smart financial planning or keeping your relationship resilient, explore our expert guides.

0 Comments