Essential Financial Planning Tips for Adults Aged 31-40 in Germany

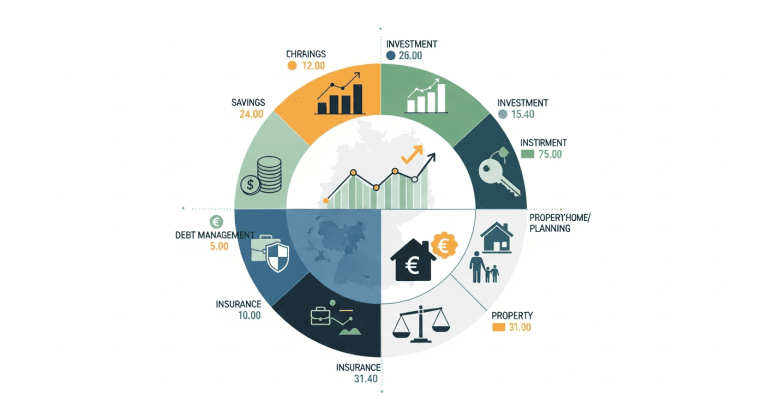

Financial planning in your 30s is a pivotal step toward securing future stability and wealth. For adults aged 31-40 in Germany, understanding the best strategies to manage income, savings, investments, and taxes is crucial.

This guide delivers practical, step-by-step financial planning tips tailored for this demographic, ensuring you optimize your money management while addressing typical challenges faced in Germany.

What Is Financial Planning and Why Is It Important for 31-40-Year-Old Adults in Germany?

Financial planning is a comprehensive approach to managing finances by setting goals, budgeting, saving, investing, and planning for taxes and retirement.

Adults in their 30s often face rising expenses such as family costs, mortgages, and career development investments. In Germany, the strong social security system and tax regulations make personal financial planning even more critical to ensure you take advantage of all benefits while preparing for the long term.

Key Financial Planning Steps for Adults 31-40 in Germany

1. Set Clear, Realistic Financial Goals

Start by defining short-, mid-, and long-term goals. Common goals for this age group include:

- Saving for a home or paying off mortgage

- Building an emergency fund

- Investing for retirement or children’s education

- Paying down debt efficiently

Tip: Use the SMART goal framework — Specific, Measurable, Achievable, Relevant, and Time-bound — to stay focused.

2. Create and Maintain a Realistic Budget

Tracking your income and expenses is fundamental. Germans generally use apps or spreadsheets to monitor cash flow effectively.

Include:

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (food, transportation, leisure)

- Debt payments

- Savings and investments

Advice: Allocate 50% of income to essentials, 30% to lifestyle, and 20% to savings and debt repayment (50/30/20 rule).

3. Build an Emergency Fund

Having 3-6 months’ worth of living expenses saved is a crucial safety net for unexpected situations like job loss or medical emergencies.

In Germany, with a solid welfare system, your emergency fund complements state support but does not replace personal financial security.

4. Optimize Your Tax Situation

Germany’s tax system offers multiple deductions and allowances:

- Claim work-related expenses (Bundesfinanzministerium Germany resource)

- Use the Riester or Rürup pension schemes for tax-advantaged retirement savings

- Consider joint filing if married for beneficial tax rates

- Keep receipts for professional education or home-office expenses

Pro Tip: Consulting a tax advisor can uncover additional savings tailored to your circumstances.

5. Smart Investing for Long-Term Wealth

Investing from your 30s maximizes compound interest benefits. Consider these options common in Germany:

- ETFs – low-cost, diversified stock index funds growing steadily

- Mutual funds tailored to risk tolerance

- Real estate investment for rental income or capital appreciation

- Retirement savings plans leveraging government incentives

Combine investments with regular contributions and risk diversification to build a resilient portfolio.

Common Financial Challenges and Solutions for 31-40 Adults in Germany

Balancing Debt and Savings

Many struggle to juggle credit card debt, student loans, or mortgages simultaneously with savings goals. Prioritize debts with the highest interest rates and avoid accumulating new debt.

Preparing for Family and Education Expenses

Children’s education or higher living costs necessitate adjusting budgets and increasing savings rates—consider specific education savings plans or state support programs available.

Inflation and Cost-of-Living Adjustments

Germany, like much of Europe, is experiencing rising inflation. Protect your assets by adjusting investments toward inflation-protected funds and revising budgets regularly.

People Also Ask (PAA) — Answered

How much should adults aged 31-40 save monthly?

Experts recommend saving at least 20% of your income. This includes contributions to retirement, emergency funds, and other investments.

What is the best investment for 31-40-year-olds in Germany?

Diversified ETFs and pension plans like Riester or Rürup are among the best options, balancing growth with moderate risk.

How can I reduce my taxes legally in Germany?

Utilize tax deductions for work expenses, charitable donations, children, and invest in approved pension schemes to lower taxable income.

Is it better to pay off debt or invest in your 30s?

Prioritize high-interest debt elimination first, then focus on investing. A balanced approach can also work depending on interest rates and investment returns.

What percentage of income should be emergency savings?

A fund covering 3-6 months of essential living costs is advisable to cover unexpected events.

Conclusion: Take Control of Your Financial Future Today

For adults aged 31-40 in Germany, disciplined financial planning is the cornerstone of lasting wealth and stability. Start by setting clear goals, maintaining a realist budget, building an emergency fund, optimizing taxes, and investing smartly.

Implement these steps consistently, and regularly review your plan to adapt to life changes and economic conditions.

Actionable Takeaway: Use budgeting tools like Finanzguru, consult a certified tax advisor, and start an ETF savings plan to maximize your finances.

0 Comments